If you have health insurance in the United States, paying for any medical care out-of-pocket is frustrating at a minimum, and personal finances may not allow it to be an option at all. However, under the Affordable Care Act, insurance companies are required to cover mental healthcare, which often includes coverage for transcranial magnetic stimulation (TMS). Yet, insurance companies vary in their coverage of treatments, and how your provider approves coverage may differ from another company.

Will Insurance Cover TMS Treatment?

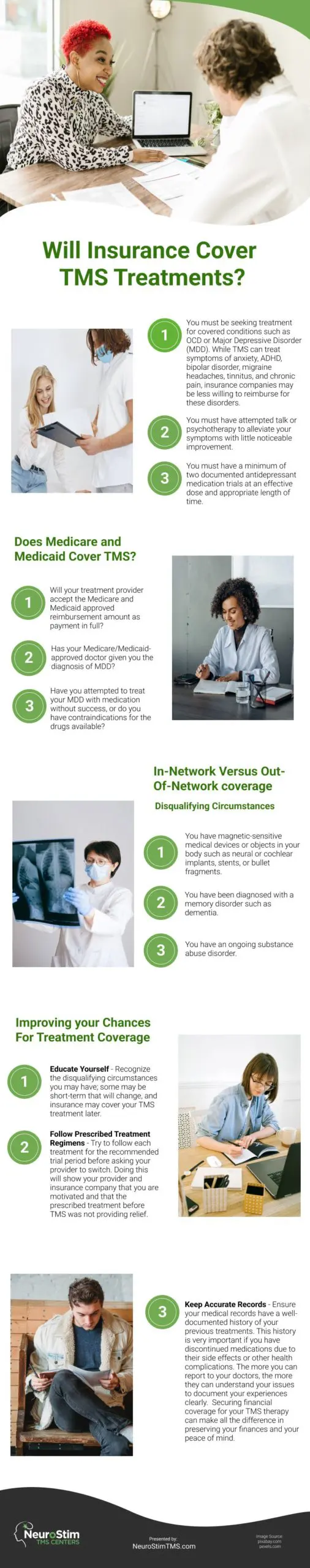

Generally, insurance companies will require treatments to be declared “medically necessary” to be covered. If your insurance company is one of the many covering TMS therapy, there may be several qualifiers you have to meet first, including the following:

- You must be seeking treatment for covered conditions such as OCD or Major Depressive Disorder (MDD). While TMS can treat symptoms of anxiety, ADHD, bipolar disorder, migraine headaches, tinnitus, and chronic pain, insurance companies may be less willing to reimburse for these disorders.

- You must have attempted talk or psychotherapy to alleviate your symptoms with little noticeable improvement.

- You must have a minimum of two documented antidepressant medication trials at an effective dose and appropriate length of time.

Be sure to check with your insurance company to determine their specific requirements.

Does Medicare and Medicaid Cover TMS Therapy?

Unfortunately, coverage varies between states, but TMS for depression may be covered. Depending on your particular plan and your ability to meet all the requirements, Medicare can cover up to 80% of your treatment. You will also need to reach your annual deductible before the coverage begins. Your monthly premiums will continue in addition to whatever percentage you are required to cover out of pocket.

Bottom line, you will be responsible for some of the treatment costs, and you should consult with your insurance company and treatment provider to see how much of the cost will fall to you before starting treatment. Here is a list of questions to answer:

- Will your treatment provider accept the Medicare and Medicaid approved reimbursement amount as payment in full?

- Has your Medicare/Medicaid-approved doctor given you the diagnosis of MDD?

- Have you attempted to treat your MDD with medication without success, or do you have contraindications for the drugs available?

In-Network Versus Out-Of-Network Coverage

If your chosen TMS provider is out-of-network, it does not necessarily mean your insurance will not cover your treatment. In-network providers have already negotiated pricing and coordinated a reimbursement process with your insurance company, making the billing, authorizations, and reimbursements much easier on you and them. If your provider is out-of-network, they have not negotiated this process with your insurance, so you may have to pay upfront at the time of treatment and seek reimbursement from your insurance company by yourself.

Be sure to check your insurance company’s approach so you are not surprised with unexpected payments and paperwork.

Disqualifying Circumstances

Even if your treatment is considered medically necessary, insurance companies may choose not to cover TMS treatment for some or all of the following reasons:

- You have a history of seizures or seizure disorders.

- You have magnetic-sensitive medical devices or objects in your body such as neural or cochlear implants, stents, or bullet fragments.

- You have been diagnosed with a memory disorder such as dementia.

- You have an ongoing substance abuse disorder.

Speak to your insurance company if you think you have any of these disqualifying characteristics before starting treatment.

Improving Your Chances For Treatment Coverage

While your insurance company will get the ultimate say on your treatment’s reimbursement, there are a few steps you can take to help your chances:

-

- Educate Yourself – Recognize the disqualifying circumstances you may have; some may be short-term that will change, and insurance may cover your TMS treatment later. Don’t give up hope if you don’t get approval immediately.

- Follow Prescribed Treatment Regimens – Stick to each prescribed treatment as closely as possible. When struggling with debilitating symptoms, it is tough not to give up prematurely. Try to follow each treatment for the recommended trial period before asking your provider to switch. Doing this will show your provider and insurance company that you are motivated and that the prescribed treatment before TMS was not providing relief.

- Keep Accurate Records – Ensure your medical records have a well-documented history of your previous treatments. This history is very important if you have discontinued medications due to their side effects or other health complications. The more you can report to your doctors, the more they can understand your issues to document your experiences clearly.

In short, your insurance should cover your TMS therapy, but there are possible exceptions. Take the time to educate yourself about your condition and the criteria your insurance provider requires you to meet to qualify for coverage. If you need to, find a loved one or friend who can help you navigate potential roadblocks to securing coverage for treatment. Securing financial coverage for your TMS therapy can make all the difference in preserving your finances and your peace of mind.

Infographic

If you think your health insurance can pay for all your medical care, you might be mistaken. Insurance companies can cover mental healthcare such as transcranial magnetic stimulation or TMS, but there are qualifiers, plus the coverage of treatment varies depending on your unique situation and location. Find out if your insurance provider can cover your TMS therapy.

Video